First quarter 2021 economic review and outlook

In this first quarter of 2021, the weather has broken, vaccine delivery is accelerating and we are starting to feel a sense of freedom may just be over the horizon. Here’s a review of the first quarter of 2021 and an outlook of what’s to come:

Review of US Production

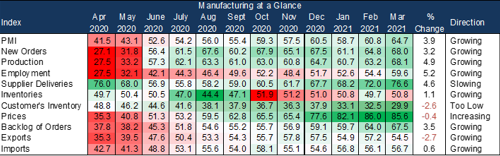

The latest Institute of Supply Manager’s Manufacturing Purchasing Managers’ Index (PMI) Report shows continued strength in manufacturing through most of the first quarter. Included in the report are direct quotations from individual respondents of the survey.

A recurring theme in these comments is increased raw material prices and the difficulty in finding reliable labor to meet production demands. A “Prices” number of 86 in February is the single highest number I can recall in any past Manufacturing PMI report. Consumer inflation has yet to materialize, but upstream prices are rising significantly.

Gross Domestic Product (GDP)

Fourth quarter 2020 GDP was reported at +4.1 percent in the latest revision. These numbers follow volatile reports of -31.4 percent GDP growth in the second quarter of 2020 and +33.4 percent growth in the third quarter of 2020. GDP growth for 2020 as a whole was reported as -3.5 percent.

The reopening of many small businesses and significant stimulus in the first quarter have allowed economic activity to snap back relatively quickly. We anticipate continued strength in the first and second quarters of 2021 as vaccine rollout and reopening increase. The challenge then becomes maintaining this growth in a post Covid-19, stimulant-free economy.

Inflation

According to the U.S. Bureau of Labor Statistics, the Consumer Price Index increased 0.4 percent in February and 1.7 percent over the last 12 months. This is an increase over the 1.2 percent increase reported last month. Yet, it is still well below the 2 percent threshold the Fed has identified as necessary to rethink monetary policy. Consumer inflation remains below the Fed’s target, but increased fuel prices and higher raw material costs may drive consumer prices higher and more quickly than currently anticipated. This is an area we are watching closely.

Employment

The March Bureau of Labor Statistics’ employment situation summary reported payrolls increased by 916,000 and the unemployment rate dropped to 6 percent. This report is a very strong one in a year of chaotic economic activity. Job creation has been consistent since the April 2020 report where we lost 20.8 million jobs. However, we still remain below pre-pandemic levels.

Equity Review and Outlook

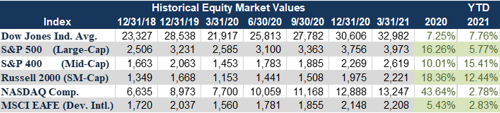

The market recovery since April of last year has been impressive. Stocks continued to rally to new all-time highs with every major index posting record numbers this quarter. The fuel for the rally continued to be provided via fiscal (government) and monetary (Fed policy) stimulus.

While the rally has continued, the participants have changed. Last summer, most of the price gains were occurring in mega-cap technology stocks. These gains pushed the S&P 500 and Nasdaq indexes to the front of the pack, with the Nasdaq posting a blistering 43 percent return in 2020.

Now, the rally has turned its focus to companies that will benefit the most from economic reopening. The first quarter was led by mid and small cap stocks, with the S&P 400 and Russell 2000 posting strong double digit returns for the quarter, while the cap weighted Nasdaq and S&P 500 lagged the field. Once again, this sector rotation highlights the importance of diversification and rebalancing verses attempts to time the market.

We anticipate stocks to continue rallying as long as aggressive stimulus is poured into the economy. Currently, the economy is being aggressively stimulated and this should push stock prices higher. When the stimulus stops and interest rates rise, equity prices will most likely correct.

Fixed Income Market Review and Outlook

The Fed continues to hold short-term interest rates to effectively zero, but longer rates have moved up significantly. The yield on the 10-year US Treasury bond has moved up from roughly 0.5 percent in August 2020 to 1.75.

This is a significant rise in rates in such a short time period and may reflect the bond trading community expressing long-term inflation concerns. Intermediate rates (5-7 years) have moved up to a level where buying these bonds is starting to make sense. The Fed has been very clear they will not be raising rates without evidence of full employment and sustained inflation greater than 2 percent. The bond market may not be as patient.

As long as fiscal stimulus money flows, there will be upward pressure on interest rates. However, the next stimulus bill looks to include significant changes to the tax code. Long-term economic outlooks could change materially, depending on how the tax code is modified. It goes without saying, this is something on which we are keeping a close eye.

Bottom Line

We appear to be at the beginning of the end of the coronavirus crisis, but the economic impact of the last 12 months will remain with us long after the virus has passed. We have seen economic stimulus delivered unlike anything in modern history, and now our politicians are evaluating how to pay for it.

Several of the changes to the tax code are focused directly at investment income and wealth transfer. These could have a significant impact on your financial plan, and we are monitoring them carefully. As the changes come into better focus, F&M Trust relationship managers stand ready to help navigate the changes necessary to protect your assets.

Warren Hurt is the vice president, chief investment officer at F&M Trust

Recent Articles

Join our e-newsletter

Sign up for our e-newsletter to get new content each month.